PPF (Public Provident Fund)

scheme was introduced by Central Government in 1968 to mobilize small savings. PPF

scheme is a popular and one of the best long-term investment schemes in India.

A PPF scheme account can be opened any Post Office and selected branches of some banks. In this post, let us take a look at SBI PPF Account and how to open PPF account in SBI.

A PPF scheme account can be opened any Post Office and selected branches of some banks. In this post, let us take a look at SBI PPF Account and how to open PPF account in SBI.

India’s biggest lender SBI

(State Bank of India) offers the facility to open a PPF account. The PPF scheme

offers risk-free returns with an attractive interest rate coupled with income

tax benefits. The scheme has a status of EEE that means exempt, exempt, exempt.

Since anyone can invest in PPF scheme easily, it provides retirement security

for salaried as well as the self-employed class of individuals.

You can open a PPF account

in SBI under the Public Provident Fund (Amendment) Scheme, 2016. PPF account

opening in SBI is always preferred by everyone in India because SBI is a

trusted name in the banking industry. Let’s know more details about PPF account

through SBI.

How to open PPF Account in SBI

To open a PPF account in State

Bank of India, you need to fill Form A and submit it at any SBI branch with

required documents. You have to mention

the name of the branch where you want your account to be opened on Form A.

PPF Account opening form (Form A)

How to get PPF account

opening form online

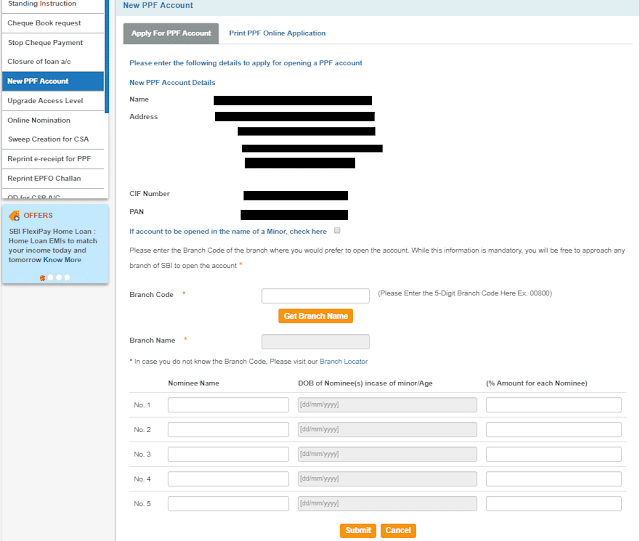

1. Login to OnlineSBI using your internet banking

Username and Password.

2. Go to the menu header and

click on “Request & Enquiries > New PPF Account”. Now you will be

directed to another page.

3. Find the “New PPF account”

under “My Accounts” appearing on the left-hand side of the screen.

4. Select the “Apply For PPF

Account” option.

5. Enter the Branch Code and

name of the branch where you would prefer to open the account. You are free to

approach any branch of SBI to open the account.

6. Provide Nominee name and

% of amount for each nominee.

7. Now go to tab “Print PPF Online

Application” and print it.

8. Kindly note that you cannot

open a PPF scheme account through Internet banking only. You have to visit a branch

for opening a PPF account in SBI with all required documents.

Eligibility to open PPF Account in SBI

A PPF scheme account can be

opened by resident Indian Individuals in their own name as well as on behalf of

a minor at any branch. HUFs (Hindu Undivided Families) are not eligible to open

PPF accounts. Only one one account of PPF can be maintained by an Individual,

except an account that is opened on behalf of a minor.

Either Mother or Father can

open a PPF on behalf of their minor child. Mother and Father both cannot open accounts

on behalf of the same minor.

Grand-parents cannot open a PPF

on behalf of minor grand-child. But in case of death of both the parents (Father

and Mother), PPF account can be opened by Grand-parents as guardians of the

Grand-child.

Documents required

Following documents are

required for opening PPF scheme account in State Bank of India.

1. Form A (PPF scheme account

opening form)

2. Nomination Form.

3. Passport size photograph

4. Copy of PAN card/ Form

60-61

5. Identity proof and

residence proof as per bank’s KYC norms.

Investments Limits in PPF Account

An individual has to deposit

a minimum of Rs. 500 and maximum Rs. 1,50,000 in a financial year. Any excess

amount deposited in PPF scheme will neither earn any interest nor will be

eligible for rebate under Income Tax Act. The amount can be deposited in a lump

sum or in a maximum of 12 installments during a financial year.

Tenure of the PPF Scheme

The original tenure of the

PPF scheme is 15 years. Thereafter, on application by the account holder, it

can be extended for 1 or more blocks of 5 years each.

Rate of Interest

The rate of interest is determined

by the Central Government on a quarterly basis. Interest is calculated on the

minimum balance between 5th day and the end of the month. Interest is paid on

31st March every year.

Transfer of PPF Scheme

A PPF scheme account can be

transferred to other branches/ other banks or Post Offices and vice versa upon

request by the account holder. The service is free of charges.

PPF Account through SBI Net Banking

SBI offers you the convenience of viewing your PPF scheme

balance, transferring funds from linked savings account online and viewing your

PPF account statement online in your SBI Net Banking Account.

Also read: Things you should know about PPF scheme

Also read: How to invest in mutual funds online?

Also read: How to start a SIP?

Also read: Post Office Time Deposit Scheme

If you liked this post, share it with your friends and colleagues through social media. Your opinion matters, please share your comments.

No comments:

Post a Comment